Automatic Rebalancing Mechanism

The Automatic Rebalancing Mechanism (ARM), stored in the smart contract, stands as the most pioneering component within our platform.

The system ensures the proper distribution of assets in the index by regularly monitoring market capitalizations, triggering adjustments to align with the desired weights, and executing trades accordingly.

This way, the ARM enables us to automatize the rebalancing process, saving considerable resources that wouldn't be possible without smart contracts and blockchain technologies.

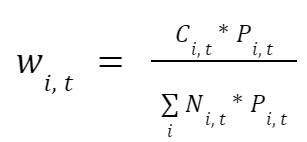

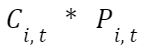

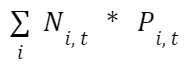

The constituents, chosen monthly from the top n based on market cap, are proportionally weighted according to their relative free float market values:

𝑖 = Each index unit 𝑡 = The moment of measurement, usually monthly for reindexing and reweighting 𝘕 = Nominal units at t 𝑃 = Price at t

Last updated