FAQ

What trading hours do your products have?

The cryptocurrency market operates 24/7, allowing users to trade at any time.

What is TP and SL?

Take Profit (TP): This type of order is used to close a position once it reaches a predetermined price. Its purpose is to secure a specified amount of profit, making it a useful tool in situations where a trader cannot actively monitor their positions.

Stop Loss (SL): This type of order is used to close a position once it reaches a predetermined price. Its primary purpose is to restrict potential losses incurred, making it a critical tool for effective risk management.

How is the management fee calculated, can you give an example?

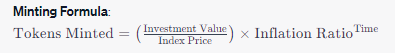

The management fee acts as an inflationary mechanism, gradually increasing the total supply of tokens over time.

Initial Scenario:

At day 0, 100 tokens are minted.

After 10 years (3650 days), there are approximately 110 tokens due to the management fee.

Example:

Minting at Day 0:

User A invests 1000 USDC.

The index price is $50.

Result -> User A receives 20 tokens.

Minting at Year 10 with 2000 USDC (index price remains at $50):

It's been 10 years since the inception, so 3650 days have passed.

The daily inflation ratio is 1% (or 1.00002615 when compounded daily).

Result -> User B receives ~44 tokens.

Management Fee:

The smart contract identifies that the last minting was 10 years ago.

The last supply was 20 tokens.

As a management fee, 2 tokens (10% of the last supply) are minted.

These 2 tokens can be seen as a fee for asset management over the 10-year period.

This fee is applied with each smart contract call, in this example, after User B mints.

Last updated